We Strategies

Our advisors help define an M&A strategy that evaluates the changing landscape of your industry to identify opportunities and targets for growth, while aligning to your enterprise’s corporate strategy

"Growth advisory: Our mantra: “Either you grow or you will perish”

M&A advisory: “The only way to grow faster & We have done it ourselves!

Exit strategy advisory: No business can grow forever”

& Creative financing strategies: Vitamin-M (Money the only fuel for your growth)

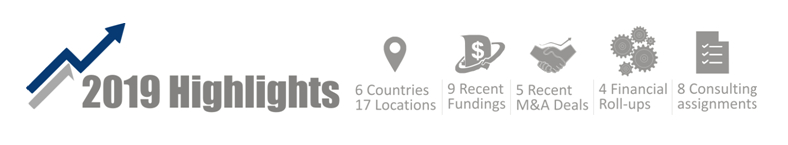

“We are the only global M&A advisory firm with over 40 years of global IT domain experience operating in 6 countries with 16 partners covering the globe with Each partner having minimum of 25 to 30 years of global IT experience. We also specialize in servicing the SMB marketplace with their immediate funding needs: Debt funding, Equity funding, working capital funding, asset based lending, urgent payroll funding, M&A funding, cash flow based loans & term loans.

We have expertise when it comes to M&A advisory for Global IT businesses. Leveraging our exclusive marketing intelligence of our global partners and active monitoring through our network of Global M&A offices, we offer clients with relevant and up-to-date knowledge of their specific business segment. This insight will enable unique opportunities to our clients and gives us a notable edge in negotiations for our global clientele”

“Have A Vision And Goal In Life First;

Then Have the Perseverance & Patience To Achieve It;

Think Big And Never Give Up”

by Late Rita Narasimham

Experts are predicting huge down fall of Economy due to the Corona. I do not know much about these experts. But I know for sure that they do not know anything about the value of human motivation and determined efforts

COVID-19 is changing everything about life and work as we know it. We’re all focused on how to best protect and support our families, employees, customers and communities in the face of this unfolding crisis. Affecting people and communities around the world, this is a difficult time for all of us. Our hearts go out to all those who have been impacted. At a time when “business as usual” is not an option, we are 100% focused on helping each other stay healthy and assisting our customers and partners to respond and adapt in this time of crisis.

Our advisors help define an M&A strategy that evaluates the changing landscape of your industry to identify opportunities and targets for growth, while aligning to your enterprise’s corporate strategy

From financial, tax, commercial and operational. HR/Benefits, and IT due diligence, to structuring advice and financing options, our dedicated advisors bring experience and knowledge to help navigate through complex closing practices

Integrating or divesting involves an additional set of challenges-costs, timelines, and disruption to business as usual, to name a few. We have leading experts for your Day 1 through end-state planning and integration needs

48 years of experience in US as Attorney/CPA with concentration in business mergers & acquisitions, taxation, immigration and international business law from 1969 to 1978

More Info

A proven innovator, investor, global business leader and a value creator. A former GE executive, he exemplifies a broad range of skills of leadership, investment, finance, technology;

More InfoFounder PEACHTREE SOFTWARE IT Industry Veteran since 1980 has over 30 years' experience in building emerging software growth and start-up technology companies

More Info

Mathur has been a crusader for the use of code coverage criteria in the estimation of software reliability or as an orthogonal metric to assess confidence in the reliability estimates. He has proposed the "Saturation Effect" as a motivating device, and as a fundamental principle, for the quantitative test assessment using an increasingly powerful suite of criteria.

Currently director of I trust lab at Singapore University of design & technology.

Specializing in cyber security for critical infrastructure. Prof Mathur taught at Birla Institute of Technology, Georgia Tech, Purdue University & Singapore university design & tech. He has published Many books & authored over 350 papers in various leading journals

More Info

You know that the best M&A deals are those that continue generating value long after the ink dries. At the same time, it’s never been more challenging to craft deals that set the stage for long-term success - because your business context is just more complex and unpredictable than ever before

STS Rural women Empowerment/Social impact is the brain Child of the (late) Rita Narasimham’s ,Who hails from Coimbatore Tamil nadu, India She was a visionary of her times and emigrated to USA in 1969 and started STS Worldwide Inc in 1979 at the age of 24 years with a vision of providing employment opportunities in USA for young IT professionals from India, Between 1980 and 1996 (until her untimely demise due to Brain cancer) she has provided employment to thousands of Indians from all over India to the united States Her vision while alive was to ultimately service the rural part of India and provide employment opportunities to rural Women and make then gainfully employed and eradicate poverty in rural areas.